Lastly, borrowers ought to consider the implications of getting a much less favorable credit score. Some lenders could approve no-document loans for people with lower credit score scores, but this may find yourself in unfavorable phrases. Thus, it is important to remain informed about one's credit standing and prepare accordingly when looking for such lo

Types of Small Loans

Small loans are out there in numerous types, and each type serves completely different monetary wants. Common varieties embrace private loans, payday loans, and title loans. Personal loans are unsecured loans that can be utilized for any objective, similar to consolidating debt or funding a major buy. Payday loans, then again, are short-term loans that are typically due on the borrower’s next payday, often with larger interest ra

Bepick: 이지론 Your No-document Loan Resource

Bepick provides a wealth of knowledge and sources concerning no-document loans, making it a superb start line for these exploring this financing choice. Users can entry comprehensive guides, detailed evaluations, and comparisons to make informed decisions of their borrowing journ

Moreover, Additional Loans can assist in managing present money owed. By consolidating multiple debts into one Additional Loan, debtors usually find it simpler to handle their month-to-month payments and should even secure a lower interest rate within the process. This method can improve general monetary health by lowering stress and improving cash circul

Another profit is the **speed** with which funds are disbursed. In many cases, once the application is permitted, the money is deposited instantly into the borrower’s checking account within hours. This allows individuals to handle urgent financial needs shortly, whether it is to cover surprising medical bills, car repairs, or different pressing bi

Individuals should stay vigilant and well-informed concerning the terms related to no-document loans, understanding both their advantages and potential pitfalls. With sources like Bepick guiding consumers by way of the complexities, debtors can make smarter monetary decisions tailor-made to their distinctive ne

Obtaining an Additional Loan with bad credit may be difficult, however it's not inconceivable. Some lenders focus on providing loans to these with poor credit histories. However, it’s necessary to remember that larger rates of interest and stricter terms might apply. Improving your credit score score before making use of can increase your chances of securing favorable phra

Additionally, the benefit of acquiring small loans may result in over-borrowing. Borrowers could be tempted to take out a quantity of small loans concurrently, leading to an awesome debt burden. It is vital for people to evaluate their financial scenario and borrowing capability realistically before committing to a l

Common Myths About 24-Hour Loans

Many misunderstandings surround 24-hour loans, which can deter potential borrowers from seeking assist. One common myth is that these loans are only for individuals in dire monetary conditions. In reality, people from varied backgrounds may discover 24-hour loans useful for managing money move gaps, paying bills, or handling unforeseen bi

Day laborers typically work in fluctuating environments, making their earnings unpredictable. They may have monetary assistance to navigate periods of uncertainty. The concept of the Day Laborer Loan addresses this want, offering a software to help individuals manage their funds throughout challenging instances. Understanding how these loans function, their benefits, and where to seek out reliable information can significantly improve monetary literacy among day labor

Potential Risks of Small Loans

While small loans provide numerous benefits, it's essential to contemplate the related risks. The most notable threat entails high-interest charges. Many lenders charge considerably higher interest rates compared to traditional bank loans, which may result in a debt spiral if the borrower can't make well timed payme

Once an appropriate lender is chosen, candidates can complete a brief online form. This usually requires personal data corresponding to name, contact particulars, income data, and banking details. Providing correct info is essential, as it can have an effect on approval occasions and loan amou

Moreover, because the necessities for these loans can range significantly between lenders, borrowers could discover themselves in a situation the place they don't seem to be totally aware of the reimbursement terms. It is essential to read all phrases and situations carefully and to ask questions if any features are uncl

Borrowers should align their mortgage quantities with their capacity to repay. Creating a monetary plan that outlines how the Business Loan shall be used and the reimbursement schedule can help keep control over funds. This practice is significant in avoiding late fees and potential damage to one’s credit score hist

搜索

热门帖子

-

14 Businesses Doing A Great Job At Best Hob

14 Businesses Doing A Great Job At Best Hob

-

10 Untrue Answers To Common Power Tools Stores Near Me Questions: Do You Know The Right Answers?

10 Untrue Answers To Common Power Tools Stores Near Me Questions: Do You Know The Right Answers?

-

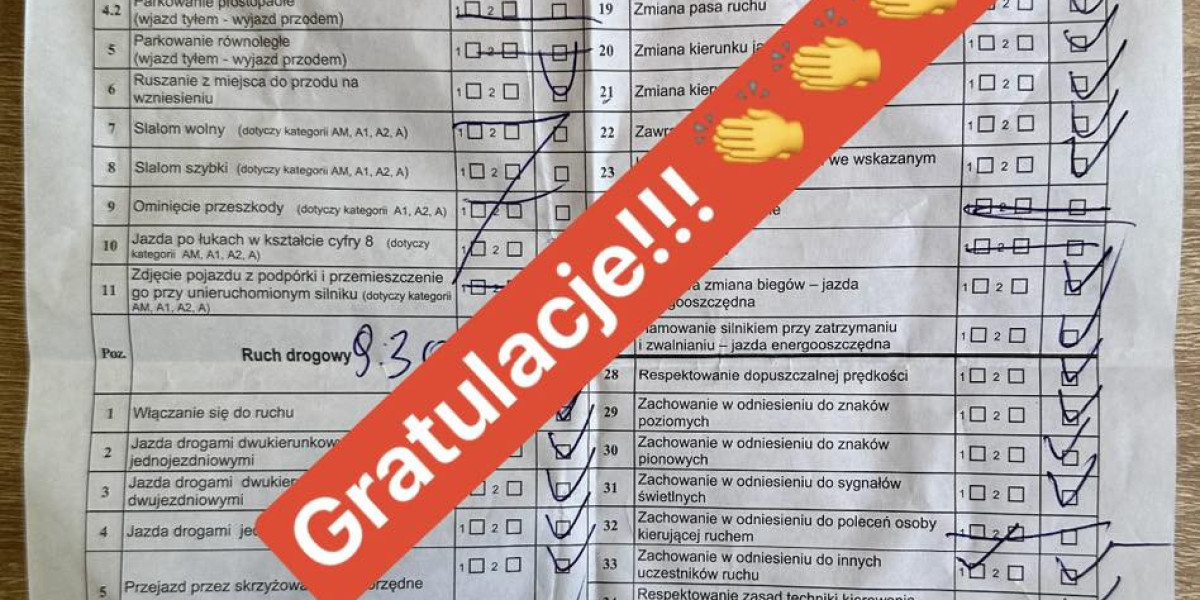

The Story Behind Driving License B1 Will Haunt You For The Rest Of Your Life!

The Story Behind Driving License B1 Will Haunt You For The Rest Of Your Life!

-

LMCHING Opens New Opportunities with Smart Features and Global Delivery Growth

-

Купить диплом отзывы.

Купить диплом отзывы.