How to Choose the Right Pawnshop

Selecting the proper pawnshop for your loan can considerably influence your expertise and the terms of the loan you obtain.

How to Choose the Right Pawnshop

Selecting the proper pawnshop for your

Loan for Credit Card Holders can considerably influence your expertise and the terms of the

Real Estate Loan you obtain. Start by researching native pawnshops and understanding their reputations. Online evaluations and customer suggestions can present useful insights into their lending practices and customer supp

This timeframe usually ranges from 30 to 90 days, depending on the pawnshop's insurance policies. It can be essential to note the **penalties for late payments**—which can further escalate the prices. To avoid falling into a debt lure, debtors should calculate their reimbursement capabilities before agreeing to any l

While no-visit loans supply quite a few advantages, corresponding to convenience and speed, it is crucial to consider both the advantages and downsides. One vital advantage is that borrowers can complete functions remotely at any time, eliminating time-consuming in-person meeti

By using superior algorithms and digital platforms, lenders can assess candidates' creditworthiness rapidly and efficiently. This results in quicker approval instances in comparability with traditional mortgage processes. Furthermore, no-visit loans often include competitive interest rates and flexible repayment choices, catering to diverse monetary situati

One of the vital thing advantages of pawnshop loans is that they do not require a credit check, making them accessible to people with poor credit score histories. Furthermore, the approval process is fast and easy, permitting debtors to receive cash in hand within hours, which may be essential in emergenc

Another appealing side is the pliability in terms and quantities that many lenders provide. Depending on the borrowing wants, individuals can often acquire loans that exactly fit their monetary situations, thus avoiding pointless d

Pawnshop loans have turn into an more and more popular monetary option for people who want quick money with out enduring a lengthy approval course of. As a priceless alternative to conventional loans, pawnshop loans provide safety via collateral and offer flexibility for borrowers. This article will discover the intricacies of pawnshop loans, their advantages and downsides, and the essential components to think about. Along the best way, we are going to introduce Be픽, a dependable on-line platform that provides complete info and reviews on pawnshop loans, helping borrowers navigate the monetary landsc

Understanding the implications of taking out unemployed loans is equally necessary. Potential borrowers ought to concentrate on their credit score scores as these can significantly affect the phrases of the loan. Moreover, accountable borrowing entails planning for reimbursement even when finances are ti

Next, understanding the compensation phrases is essential. Borrowers ought to assess the mortgage period, month-to-month payments, and any penalties for early repayment. Knowing these details will assist in choosing a mortgage that aligns with one's monetary habits and targ

However, it's vital to bear in mind that the comfort of 24-hour loans usually comes with a catch—higher rates of interest. Borrowers ought to assess their capability to repay promptly to avoid monetary pressure down the str

In today’s fast-paced world, financial emergencies can arise unexpectedly, requiring quick entry to funds. The 24-hour loan concept has gained significant traction because it presents fast monetary solutions, making certain people have the resources they need, sometimes even within the identical day. With numerous options available, understanding the nuances of 24-hour loans becomes essential for debtors looking for swift assistance. This article explores what 24-hour loans are, their types, advantages, and suggestions for applying, while additionally introducing Bepick, a comprehensive platform that provides detailed info and reviews about such financial merchand

Peer-to-peer lending platforms have also emerged as a contemporary resolution for individuals seeking personal loans. They match borrowers with individual traders willing to lend money, typically at aggressive charges. Exploring these choices may help borrowers find one of the best monetary solution for his or her state of affairs whereas minimizing dangers related to pawnshop lo

Eligibility standards for no-visit loans can range by lender, however generally embody factors similar to age, earnings, credit history, and residency standing. It's essential for applicants to evaluate particular requirements for every lender, and a few could offer choices for people with less-than-perfect cre

Another benefit is the speed of approval and funding. Borrowers can typically complete an software in minutes. Once permitted, the funds can be deposited in their bank accounts nearly immediately, permitting them to address pressing financial wants directly. Many people recognize this facet of daily loans, especially during emergenc

14 Businesses Doing A Great Job At Best Hob

Förbi ovensandhobs7300

14 Businesses Doing A Great Job At Best Hob

Förbi ovensandhobs7300 10 Untrue Answers To Common Power Tools Stores Near Me Questions: Do You Know The Right Answers?

Förbi powertoolsonline8930

10 Untrue Answers To Common Power Tools Stores Near Me Questions: Do You Know The Right Answers?

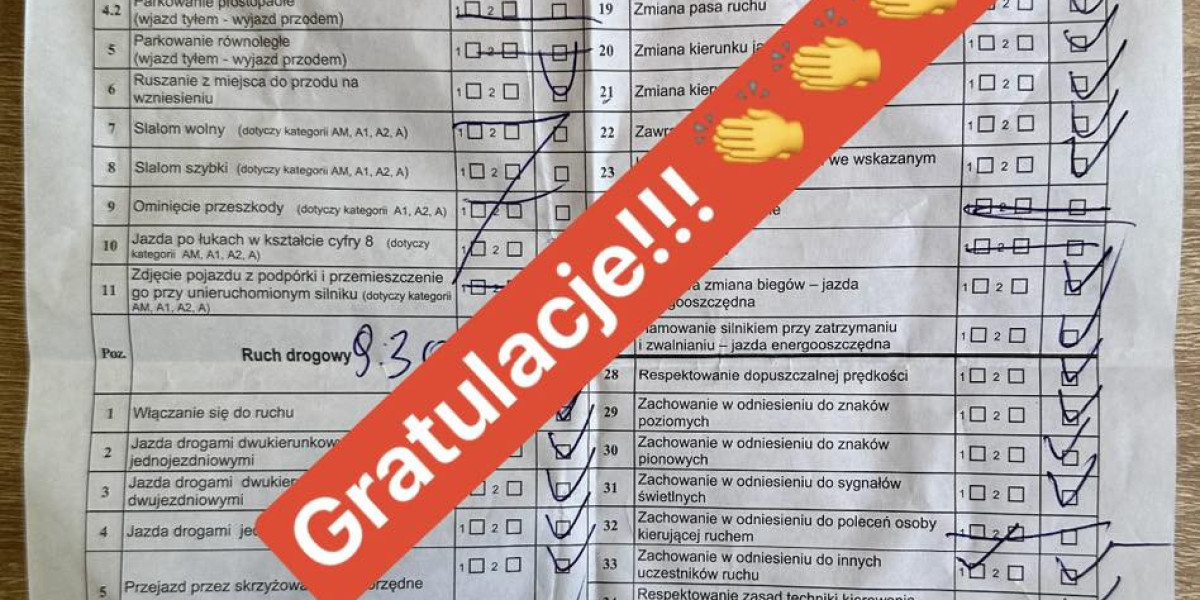

Förbi powertoolsonline8930 The Story Behind Driving License B1 Will Haunt You For The Rest Of Your Life!

Förbi kartaxpresspoland9984

The Story Behind Driving License B1 Will Haunt You For The Rest Of Your Life!

Förbi kartaxpresspoland9984 Купить диплом отзывы.

Förbi lynnheinz82844

Купить диплом отзывы.

Förbi lynnheinz82844LMCHING Opens New Opportunities with Smart Features and Global Delivery Growth

Förbi vidafison45121