What is a Delinquent Loan?

A delinquent loan is a kind of debt that has not been repaid by the borrower according to the agreed-upon schedule.

What is a Delinquent Loan?

A delinquent loan is a kind of debt that has not been repaid by the borrower according to the agreed-upon schedule. When a borrower misses a fee, the loan becomes delinquent, and this standing can escalate over time relying on the length and frequency of missed payments. Generally, a loan is taken into account delinquent after 30 days of missed payment, and extended delinquency may result in foreclosure or loan charge-off, deeply affecting the borrower’s credit rat

Additionally, if a borrower defaults on a mortgage or fails to meet cost deadlines, they might incur late fees. Moreover, such defaults can negatively have an result on credit scores, leading to long-term monetary difficult

The Role of BePick

BePick serves as an essential platform for people in search of info on Card Holder Loans. It offers in-depth evaluations, comparisons, and insights into varied lenders and their mortgage merchandise. Users can access a wealth of resources to help them navigate the complexities of non-public finance, particularly when considering Card Holder Lo

Causes of Loan Delinquency Delinquency can come up from numerous components impacting a borrower’s ability to fulfill repayment obligations. Understanding these causes is instrumental in preventing delinquent loans from occurring. Common causes embrace monetary hardship, unexpected medical expenses, job loss, or even poor budgeting practices that go away little room for emergenc

Moreover, the stress of managing multiple loans may exacerbate anxiousness during already challenging instances. It’s crucial for borrowers to completely understand the phrases of the mortgage and to have a strong plan for repayment in place before proceed

Understanding Unemployed Loans

Unemployed loans are specifically designed for people who're presently out of labor and may be struggling with their finances. These loans typically come with specific conditions tailored to the distinctive circumstances of the unemployed. Typically, these loans could be categorized into various varieties, including private loans, government help loans, and specialized mortgage applications provided by certain lenders. Understanding the terms and conditions, in addition to the potential dangers, is significant for anybody considering this monetary ave

The implications of delinquency vary depending on the kind of loan. For occasion, a mortgage delinquency can result in foreclosure, whereas credit card debt can result in higher rates of interest and additional fees. Borrowers must be aware that delinquent loans not only impact their finances but in addition have an result on their future borrowing capabilit

Ultimately, understanding how interest rates work is essential for debtors when deciding on acquiring a Card Holder Loan. Being well-informed will aid in making decisions that align with one's monetary go

Once accredited, debtors must pay consideration to the mortgage terms, interest rates, and compensation schedules. It's crucial to grasp all elements of the loan—missed funds can lead to additional fees, increased interest rates, and an additional decline in credit score sc

Finally, do not hesitate to ask questions and make clear any considerations instantly with potential lenders. A respected lender will gladly provide clear solutions and transparency about their offeri

Other contributing elements might involve misunderstandings regarding loan terms

이지론. Borrowers won't clearly perceive their payment schedules or could overlook the implications of defaulting on a mortgage. Effective communication between lenders and borrowers can mitigate these issues and promote better monetary hab

Second, a loan calculator enables you to experiment with completely different loan situations. For instance, you might wish to see how rising your down cost can decrease your month-to-month funds. By analyzing various inputs, you acquire insight into how you can save money over the lifespan of the mortg

In addition to reviews and tutorials, BePick features frequently requested questions and skilled advice, permitting potential borrowers to make clear their doubts and streamline their loan analysis process. The comprehensiveness of the knowledge ensures that customers are well-informed and might select the right auto

Business Loan that aligns with their financial objecti

BePick's Role in Navigating Credit-deficient Loans

BePick serves as a priceless on-line resource for those looking for details about credit-deficient loans. With comprehensive reviews and detailed insights, the platform goals to teach borrowers about their options, helping them make knowledgeable monetary decisions. Whether you're contemplating a credit-deficient loan for the primary time or trying to refinance existing debt, BePick supplies important tools and sour

Furthermore, read reviews and testimonials from other debtors to gauge a lender's reliability and customer service. Understanding how a lender has treated previous clients can present useful perception into what to expect and whether or not they will provide enough assist all through the loan course

14 Businesses Doing A Great Job At Best Hob

14 Businesses Doing A Great Job At Best Hob

10 Untrue Answers To Common Power Tools Stores Near Me Questions: Do You Know The Right Answers?

10 Untrue Answers To Common Power Tools Stores Near Me Questions: Do You Know The Right Answers?

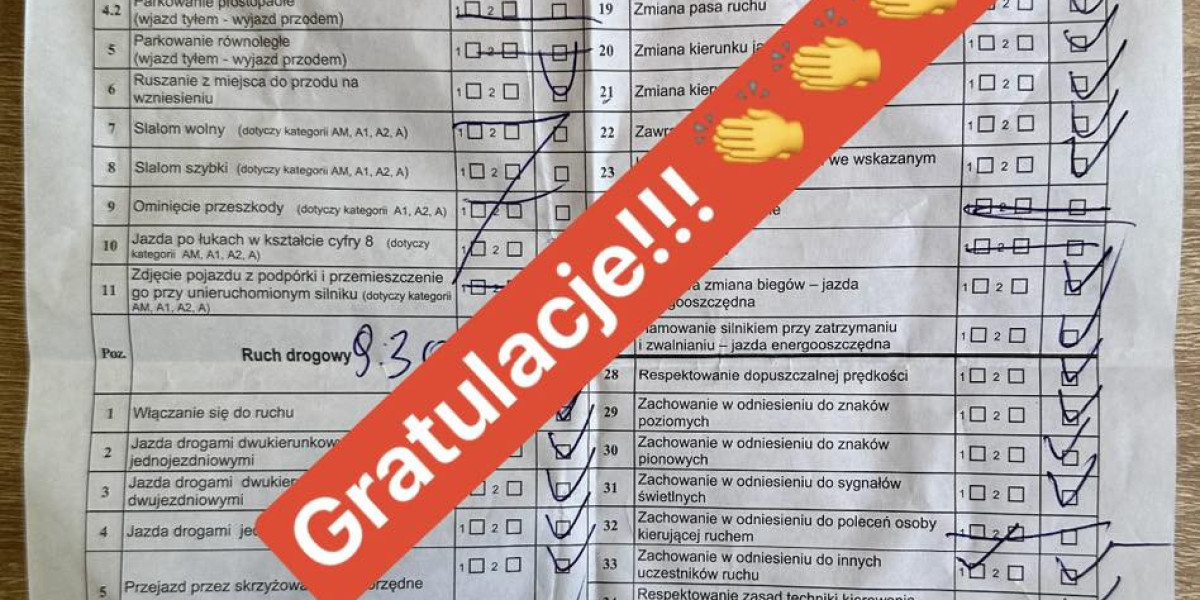

The Story Behind Driving License B1 Will Haunt You For The Rest Of Your Life!

The Story Behind Driving License B1 Will Haunt You For The Rest Of Your Life!

LMCHING Opens New Opportunities with Smart Features and Global Delivery Growth

Innovation Amid Crackdown: Inside Nigeria's Dynamic Sports Betting Landscape

Innovation Amid Crackdown: Inside Nigeria's Dynamic Sports Betting Landscape