Yes, every day loans can impact your credit score rating. If you make timely repayments, they may help build your credit score historical past positively.

Yes, every day loans can impact your credit score rating. If you make timely repayments, they may help build your credit score historical past positively. Conversely, late funds can lead to unfavorable effects in your credit rating. Therefore, it's vital to handle repayments diligently to maintain a wholesome credit score prof

Once a lender is selected, the borrower might want to fill out an application, offering essential documentation regarding revenue and financial historical past. The lender will review this info to determine eligibility and, if approved, the funds can usually be accessed rapi

Common Misunderstandings About Unsecured Loans

Unsecured loans often come with various misconceptions. One frequent misunderstanding is that they are solely obtainable to those with wonderful credit score scores. While a great credit score score can enhance your possibilities of approval, there are lenders that supply unsecured loans to people with decrease scores, albeit with higher rates of inter

The Role of Betting in Daily Loan Information

Betting serves as a complete platform providing detailed data and critiques on day by day loans. The website assists users in navigating the complex panorama of short-term borrowing by offering relevant insights into varied lending choices. Users can discover articles that element the professionals and cons of different lenders, potential pitfalls, and ideas for profitable borrowing. By utilizing such resources, individuals can make educated selections based mostly on personal financial situations, thereby maximizing the benefits of day by day loans whereas minimizing related ri

Choosing the Right Lender

Selecting the proper lender for a day by day loan can considerably influence the borrowing expertise. It’s essential to analysis varied lenders, comparing their rates of interest, fees, and reimbursement phrases. Reading buyer evaluations can provide insight into the lender’s popularity and customer service quality. Additionally, legitimate lenders might be transparent in regards to the complete price of borrowing and can present clear details about reimbursement schedules. Tools and sources obtainable on platforms like Betting can information potential debtors in making informed decisi

Before taking an employee mortgage, evaluate your financial state of affairs thoroughly. Consider the mortgage amount, compensation terms, and interests. Make certain that you could comfortably fit the repayment into your budget. Additionally, assess the purpose of the mortgage and ensure it aligns together with your long-term monetary targ

Prioritizing higher-interest loans also can prevent cash in the lengthy run. If attainable, consider making further payments toward the principal balance, which is in a position to reduce overall curiosity and shorten the loan term. This technique can be particularly efficient with unsecured loans, the place every little bit counts in course of reducing your monetary bur

Importantly, many lenders don't conduct rigorous credit score checks, making Daily Loans accessible even to these with poor or no credit score historical past. However, this leniency can come at a price, as greater interest rates are often utilized to offset the increased threat to lend

The Application Process

The software process for employee loans tends to be less cumbersome than that of traditional lending institutions. Typically, employees can approach their HR departments to express their interest and acquire

이지론 the necessary types. Most employers aim to streamline this course of to ensure workers aren’t deterred by lengthy waiting durati

Whether you’re a first-time borrower or an skilled 이지론 mortgage seeker, BePick provides useful sources to navigate the unsecured mortgage panorama successfully. It is an important software for anybody looking to discover their options in unsecured lend

BePick: Your Go-To Resource for Unsecured Loans

BePick is a complete platform that provides detailed data and critiques of unsecured loans. By visiting BePick, customers can discover insights into various lending options, helping them make well-informed choices based mostly on their distinctive financial wants. The platform is designed to offer a user-friendly experience, permitting people to check totally different

Emergency Fund Loan merchandise sim

Best Practices for Repaying Unsecured Loans

Repaying an unsecured loan requires a disciplined method to manage your funds successfully. Setting up automated payments may help be positive that you never miss a due date, which is essential for sustaining a good credit score score. Additionally, creating a compensation plan might help you visualize your debt and track your progr

After selecting a lender, debtors typically complete an online software. This might embody offering personal data, monetary particulars, and probably undergoing a credit check. Upon approval, funds can typically be disbursed rapidly, sometimes within a number of business days, making unsecured loans an appealing option for pressing financial ne

14 Businesses Doing A Great Job At Best Hob

על ידי ovensandhobs7300

14 Businesses Doing A Great Job At Best Hob

על ידי ovensandhobs7300 10 Untrue Answers To Common Power Tools Stores Near Me Questions: Do You Know The Right Answers?

על ידי powertoolsonline8930

10 Untrue Answers To Common Power Tools Stores Near Me Questions: Do You Know The Right Answers?

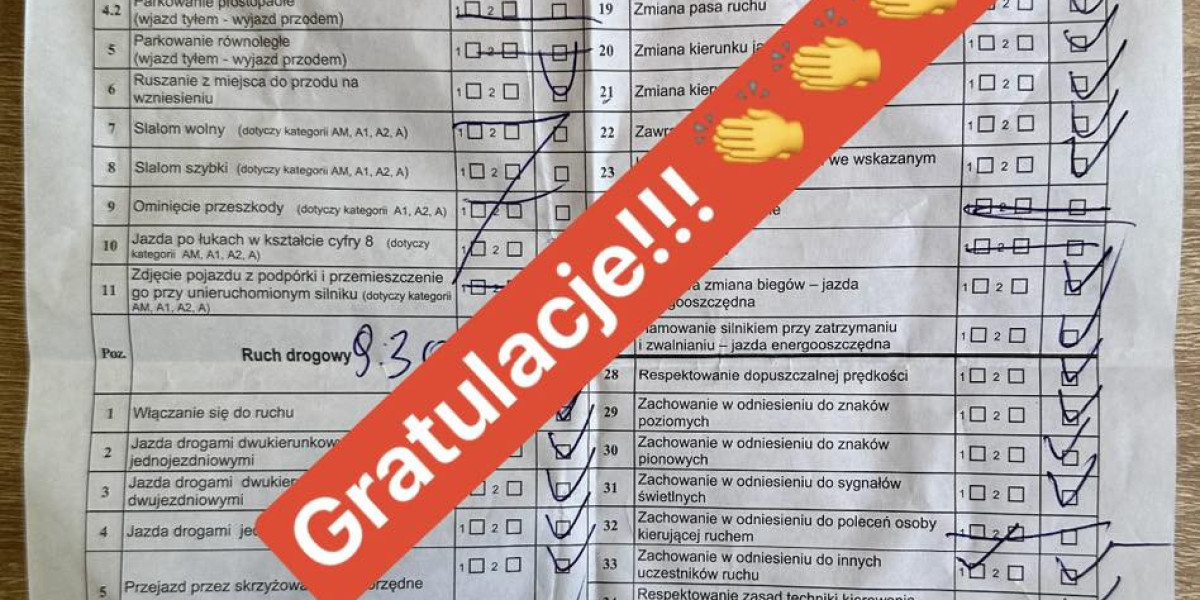

על ידי powertoolsonline8930 The Story Behind Driving License B1 Will Haunt You For The Rest Of Your Life!

על ידי kartaxpresspoland9984

The Story Behind Driving License B1 Will Haunt You For The Rest Of Your Life!

על ידי kartaxpresspoland9984LMCHING Opens New Opportunities with Smart Features and Global Delivery Growth

על ידי vidafison45121 Innovation Amid Crackdown: Inside Nigeria's Dynamic Sports Betting Landscape

על ידי nadia40n839612

Innovation Amid Crackdown: Inside Nigeria's Dynamic Sports Betting Landscape

על ידי nadia40n839612