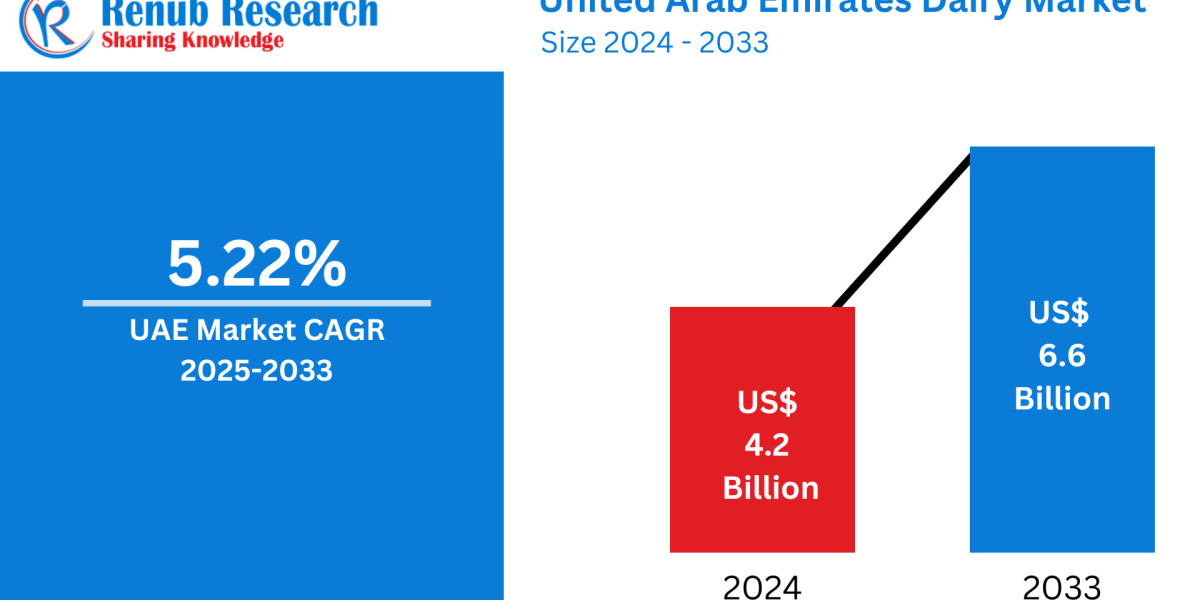

United Arab Emirates Dairy Market Size, Share, Forecast 2025–2033

Market Overview

The United Arab Emirates Dairy Market is projected to grow from US$ 4.20 billion in 2024 to US$ 6.60 billion by 2033, reflecting a CAGR of 5.22% during the forecast period. This growth is driven by multiple factors including a rising population, urbanization, changing dietary habits, increasing health consciousness, government support, and rapid innovation in the dairy sector. Despite a significant portion of local production, the UAE remains reliant on dairy imports to satisfy domestic demand—particularly for premium and specialized products.

Key Market Drivers

1. Rapid Urbanization and Population Growth

The UAE's population reached 10.17 million in 2023, with 88.5% comprised of expatriates. Urban hubs like Dubai and Abu Dhabi exhibit increased demand for dairy due to growing household numbers and rising preference for convenience foods. With the evolution of urban lifestyles, demand for diverse dairy options such as bottled milk, cheese, and yogurt is steadily increasing.

2. Health and Wellness Awareness

Health-driven choices are shaping the UAE dairy landscape. The growing prevalence of obesity (39% of adults) and chronic conditions such as osteoporosis and diabetes has prompted consumers to seek low-fat, lactose-free, and fortified dairy products. Probiotic yogurts, vitamin-D fortified milk, and functional products with omega-3 and calcium are gaining popularity.

3. Product Innovation and Diversification

Consumer demand for tailored and value-added dairy products has led to innovations like:

- Plant-based alternatives (almond, oat, and soy milk)

- Protein-rich yogurts

- Flavored and functional beverages This trend is further supported by government initiatives promoting local, organic, and sustainable dairy innovations.

4. Government Support and Food Security Initiatives

The UAE National Food Security Strategy 2020 prioritizes reducing import dependency and enhancing domestic food production. Key initiatives include:

- Modernizing dairy farms with precision agriculture

- Improving animal health management and milk yield

- Investment in vertical farming and imported feed systems These steps support local producers while aligning with sustainability goals.

Key Market Challenges

1. Climate Constraints and Limited Arable Land

The harsh desert climate, coupled with scarce fertile land, limits large-scale dairy farming. As a result, the UAE imports a significant portion of its dairy needs, leading to higher operational costs and exposure to global supply chain disruptions.

2. Heavy Import Dependency

UAE’s reliance on imports for raw materials and finished dairy products results in price volatility, especially during geopolitical instability or transportation bottlenecks. It also limits the ability of local producers to maintain competitive pricing, impacting overall market sustainability.

Related Report

Regional Market Analysis

Dubai Dairy Market

Dubai is a key consumption hub due to its diverse expatriate population, high urbanization rate, and increased disposable incomes. While import dependency remains high, there is a growing preference for nutrient-rich, health-conscious dairy options. Both established and emerging players are expanding portfolios to cater to this dynamic demand.

Abu Dhabi Dairy Market

The capital’s dairy market benefits from government-backed food security projects, combined with a growing middle class. The demand for premium and functional dairy products is increasing, driven by rising health awareness. Key players are introducing products enriched with vitamins and probiotics to align with evolving consumer expectations.

Sharjah Dairy Market

Sharjah presents steady growth due to rising household consumption and youth-driven health trends. While the region remains dependent on imports, growing interest in plant-based and organic dairy items is creating opportunities for brands to innovate and cater to changing lifestyles.

Segmental Analysis

By Product Type

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Others

Yoghurt, Cheese, and Plant-Based Milk Alternatives are among the fastest-growing categories due to consumer health trends.

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail Stores

- Others

Online retail is witnessing exponential growth as digital platforms become mainstream shopping destinations for dairy, especially among younger, tech-savvy consumers.

By Region

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape

Company Profiles (Covered from 4 Viewpoints: Overview, Key Persons, Revenue, Recent Developments)

- Danone SA

- The Kraft Heinz Company

- Fonterra Co-Operative Group

- Nestle SA

- General Mills Inc.

- Royal Frieslandcampina NV

- Groupe Lactalis

- Arla Foods amba

- Al Rawabi Dairy Company

- National Food Products Company

These companies are increasingly investing in local partnerships, technology-driven production, and product innovation to sustain their competitiveness.

Strategic Insights & Future Outlook

Key Questions Addressed:

- How will UAE’s import dependency evolve in the face of local production initiatives?

- Which dairy segments are expected to drive the highest revenue in the coming years?

- What role will plant-based and functional dairy products play in shaping the UAE dairy market?

- How are government policies and health campaigns influencing consumer behavior?

Market Forecast:

The UAE dairy industry is undergoing a transformation, balancing between import reliance and localized sustainability efforts. With strong policy backing, consumer demand for healthy, functional, and convenient dairy solutions is expected to drive robust growth through 2033.

Report Details

Feature | Description |

Base Year | 2024 |

Historical Period | 2020–2024 |

Forecast Period | 2025–2033 |

Market | US$ Billion |

Segments Covered | Product Type, Distribution Channel, Region |

Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

Companies Covered | 10 Major Dairy Companies |

Customization Scope | 20% Free Customization |

Analyst Support | 1-Year Post-Sale Support |

Delivery Format | PDF + Excel (Editable Word/PPT format available on request) |

Available Licenses

- Dashboard (Excel): $2,490

- Single User License (PDF): $2,990

- Five User License (PDF + Excel): $3,490

- Corporate License (Multi-User): $3,990

Contact Us

Renub Research

? USA: +1-478-202-3244

? India: +91-120-421-9822

? Email: [email protected]

[Request Sample] | [Request Customization]