United States Coffee Market Report: Industry Size, Share, Trends, Forecast 2025–2033

Market Overview

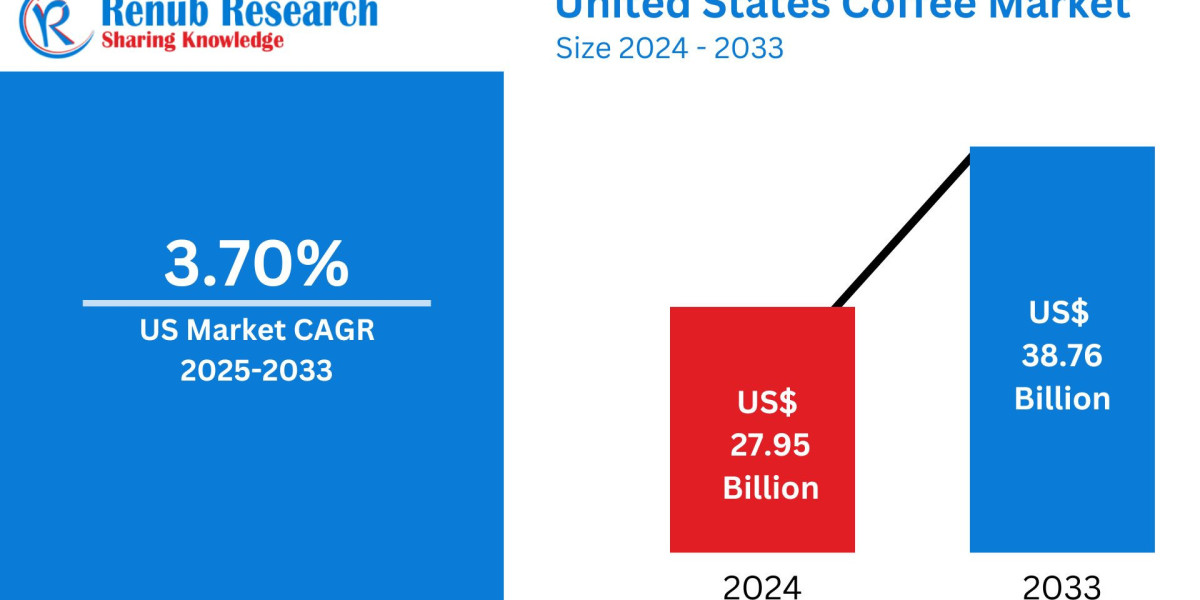

The United States Coffee Market is forecast to reach US$ 38.76 Billion by 2033, rising from US$ 27.95 Billion in 2024, growing at a CAGR of 3.70% during 2025–2033. The robust growth trajectory is fueled by rising consumer demand for specialty and premium coffees, increased café culture, innovation in ready-to-drink (RTD) formats, and an expanding e-commerce presence.

Coffee has long been a staple of American culture, symbolizing productivity, social interaction, and indulgence. With millions of Americans starting their day with a cup of coffee, the industry continues to evolve, reflecting changes in consumer behavior, health consciousness, and digital engagement.

Key Market Drivers

1. Surging Demand for Specialty and Premium Coffee

The demand for specialty coffee, including single-origin, organic, and ethically sourced beans, is reshaping the market. These high-quality products resonate with modern consumers who value flavor, sustainability, and traceability. Artisan roasters and third-wave coffee shops are setting new standards with pour-over, siphon, and cold brew methods.

? October 2024: Peace Coffee, a Minneapolis-based company, launched an Organic and Fair-Trade Premium Cold Espresso Concentrate using its signature Yeti Blend.

2. Rising Popularity of RTD and Cold Brew Coffee

RTD coffee has carved a strong niche among busy, health-conscious consumers. RTD lattes, nitro cold brews, and plant-based coffee drinks are now available in mainstream retail chains and online.

? September 2024: Nestlé's Nespresso introduced its first RTD product, "Master Origins Colombia Coffee", a honey-sweetened cold brew available exclusively in the U.S.

3. E-Commerce and DTC Sales Boom

Online coffee sales and subscription models have transformed consumer access. Digital-first brands offer customizable options and unique flavors, while delivery convenience enhances retention.

? March 2024: Vietnamese brand Nguyen Coffee Supply partnered with Gopuff to deliver nationwide from 500+ fulfillment centers.

Market Challenges

1. Price Volatility and Supply Chain Disruptions

Climate-related events in Brazil, Colombia, and Vietnam continue to disrupt global coffee bean supply. Freight costs, import tariffs, and currency fluctuations further complicate operations and pricing strategies in the U.S. market.

2. Competition from Functional and Plant-Based Beverages

The coffee market is facing increasing competition from alternatives like matcha, kombucha, and adaptogenic drinks. These options are often marketed as healthier, lower-caffeine substitutes with added benefits like immunity boosting and stress reduction.

Related Report

Product Type Analysis

Whole Bean Coffee

Favored by purists and home brewers, whole bean coffee remains a top choice among premium consumers. Innovations in fair-trade, shade-grown, and single-origin beans are influencing purchase decisions.

? February 2024: Cherry Coffee expanded into wholesale distribution after acquiring Dallas-based Novel Coffee Roasters, strengthening its whole bean portfolio.

Ground Coffee

Widely used for its convenience, ground coffee dominates retail shelves and home brewers. It remains a mainstream choice across both traditional and specialty categories.

Instant Coffee

Once seen as inferior, instant coffee is undergoing a premium makeover. Freeze-dried and specialty instant blends are gaining popularity, especially for travelers and office workers.

? October 2024: Civilized Coffee launched Instant Mocha Powders, blending convenience with café-style quality.

Coffee Pods and Capsules

Driven by Nespresso and Keurig, this segment appeals to time-conscious consumers. Sustainability concerns have led to the rise of compostable and reusable pods, offering eco-conscious alternatives.

Distribution Channel Insights

Supermarkets/Hypermarkets

These remain dominant due to bulk pricing, wide brand availability, and in-store promotions. Chains like Walmart, Kroger, and Costco continue to push private label offerings while expanding their specialty coffee aisles.

Convenience and Grocery Stores

Smaller formats thrive on impulse buying and serve as critical access points for RTD products. High turnover and quick accessibility define this segment.

Online Retail

The fastest-growing channel, thanks to subscription models, direct brand websites, and platforms like Amazon. Customers can explore niche roasters, rare beans, and curated packs from the comfort of home.

Other Channels

This includes cafés, restaurants, and specialty outlets, which play a significant role in both consumption and branding. Chains like Starbucks and Dunkin’ also act as trendsetters and brand influencers.

Competitive Landscape

Leading Players in the U.S. Coffee Market

The market is intensely competitive, with a mix of legacy giants and agile specialty brands. Companies focus on innovation, sustainability, digital marketing, and acquisitions to gain market share.

Company | Recent Developments |

Nestlé S.A. | Introduced RTD cold brew under Nespresso in 2024 |

Starbucks Corporation | Continued global expansion and RTD partnerships |

Keurig Dr Pepper Inc. | Dominates the pods and capsules category |

The J.M. Smucker Co. | Offers Folgers and Café Bustelo brands |

Califia Farms LLC | Leads in plant-based and functional cold brews |

Other Key Players:

Eight O' Clock Coffee Company, Kraft Heinz Co., Fresh Roasted Coffee LLC, White Wave Food Co., Monster Beverage Corporation

Market Segmentation

By Product Type

- Whole Bean

- Ground Coffee

- Instant Coffee

- Coffee Pods and Capsules

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail

- Other Channels

Key Questions Answered by Renub Research

- What is the expected size and CAGR of the U.S. Coffee Market by 2033?

- US$ 38.76 Billion by 2033 at a CAGR of 3.70% from 2025–2033.

- What drives the specialty coffee trend in the United States?

- Consumer preference for premium, organic, and ethically sourced blends.

- How is RTD coffee reshaping consumption habits?

- Offering convenience and variety to health-conscious, on-the-go consumers.

- What is the role of e-commerce in the coffee industry?

- Enables subscription services, home delivery, and niche product access.

- What challenges impact the U.S. coffee industry most?

- Coffee bean price volatility and competition from health drinks.

- Which product segment leads in market share?

- Ground and whole bean coffee dominate due to quality and consumer familiarity.

- How are major players adapting to changing consumer demands?

- Through product innovation, sustainability, and personalized digital engagement.

Report Scope

Feature | Details |

Base Year | 2024 |

Forecast Period | 2025–2033 |

Market Units | US$ Billion |

Coverage | By Product Type, By Distribution Channel |

Companies Profiled | 10 Leading Players |

Customization | 20% Free Customization |

Post-Sale Support | 1 Year |

Delivery Format | PDF & Excel (PPT/Word on request) |

Why Choose Renub Research?

Renub Research delivers comprehensive insights through reliable forecasting, deep industry analysis, and strategic recommendations. With 15+ years of global market research expertise, we offer tailored reports to match your business goals.

? Request Sample | ? Request Customization | ? Talk to Our Analyst

? Email: [email protected]

? Call: USA +1-478-202-3244 | India +91-120-421-9822

? Website: www.renub.com