Global 4K Medical Imaging Market Size, Share, Forecast, and Trends Analysis (2025–2033)

Market Overview

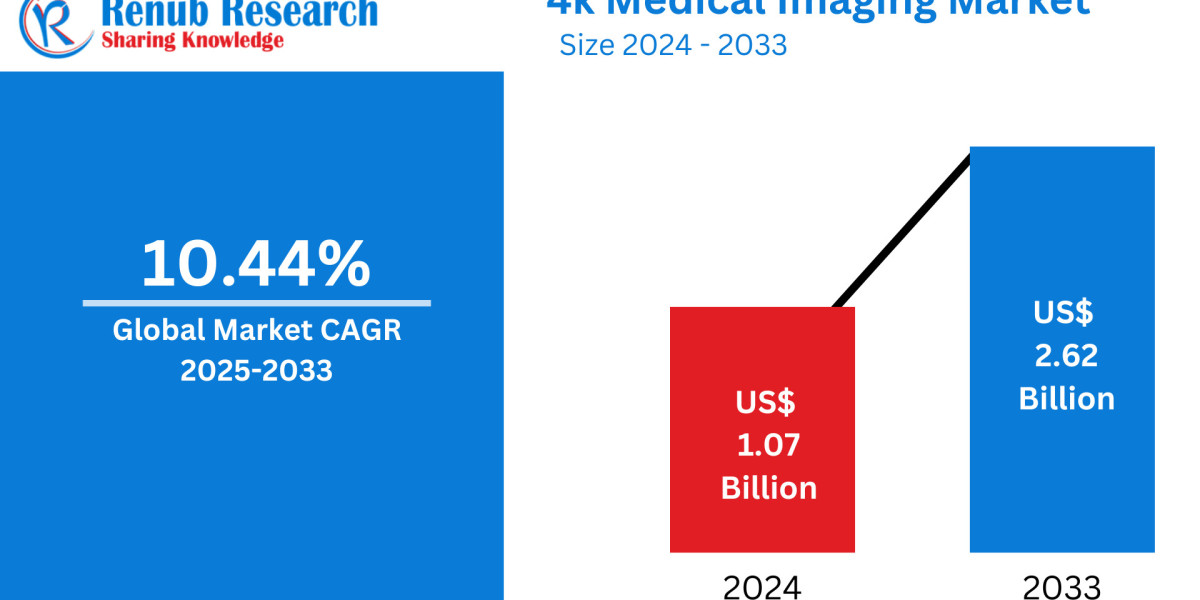

The Global 4K Medical Imaging Market is projected to reach US$ 2.62 Billion by 2033, up from US$ 1.07 Billion in 2024, growing at a robust CAGR of 10.44% during 2025 to 2033. This growth is driven by rapid technological advancements, increasing demand for ultra-high-definition imaging in diagnostics and surgeries, rising global healthcare expenditure, and the increasing prevalence of chronic diseases among the aging population. Furthermore, the widespread adoption of minimally invasive surgical techniques has further fueled the demand for high-clarity visualization technologies like 4K imaging.

What is 4K Medical Imaging?

4K medical imaging refers to ultra-high-definition imaging with a resolution of 3840 x 2160 pixels, offering four times the clarity of standard HD (1080p). This clarity enhances the visualization of tissues, blood vessels, and anatomical structures during diagnostic procedures and surgeries. In specialties like endoscopy, laparoscopy, radiology, and neurosurgery, 4K imaging plays a transformative role by improving precision, reducing error rates, and ultimately enhancing patient outcomes.

Key Market Drivers

1. Rising Demand for Precision and Visualization in Healthcare

There is a growing preference among healthcare providers for enhanced visualization tools to support complex diagnostics and image-guided interventions. 4K imaging systems help physicians detect subtle anomalies earlier and with higher accuracy. An example is Stryker's 1788 Advanced Imaging Platform, launched in India in 2024, which integrates 4K imaging with OLED displays and wide color gamut to improve surgical visualization.

2. Technological Advancements in Imaging and Data Management

Emerging 4K imaging systems are not just about visual clarity—they also incorporate advanced video recording, real-time data sharing, and cloud integration. For instance, MediCapture’s MVR 4K platform supports dual 4K inputs and advanced data management with 1TB onboard storage, enabling seamless integration with hospital PACS systems and secure video archiving.

3. Increasing Demand for Minimally Invasive Surgeries

The global shift toward minimally invasive procedures is a strong growth catalyst. 4K technology enhances precision during such operations by offering surgeons a magnified and detailed view of the operative field. For example, Olympus launched its CH-S700-08-LB camera head in 2024, combining 4K white light, blue light, and NBI (Narrow Band Imaging) to assist in detecting and resecting bladder tumors.

Major Challenges

1. High Maintenance and Operational Costs

One of the primary concerns for healthcare facilities is the high cost of maintenance for 4K systems. These platforms often require frequent updates, recalibration, and technical support. For smaller hospitals or clinics in emerging markets, these costs may be a barrier to adoption.

2. Integration Issues with Legacy Systems

Most hospitals still operate legacy imaging and electronic health record systems that lack compatibility with advanced 4K platforms. Integration of 4K systems with older IT infrastructure or PACS often demands significant investment in upgrades and specialized training.

Market Segmentation

By Type

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- X-ray

- Ultrasound

- Others (Endoscopy, Fluoroscopy, etc.)

By End User

- Hospitals

- Diagnostic Imaging Centers

- Specialty Clinics

- Others

Regional Market Insights

North America: Leading the Global Market

North America remains the global leader, especially the United States, driven by advanced hospital infrastructure, rapid adoption of cutting-edge technologies, and growing demand for image-guided procedures. In 2023, Viseon Inc. introduced the 4K MaxView System for spine surgery, showcasing the country's innovation in surgical imaging.

Europe: Rising Investments in Precision Imaging

Countries like Germany, the UK, and France are witnessing strong adoption of 4K systems, propelled by aging populations and government support for high-tech healthcare equipment. Germany, in particular, is a hub for medical device innovation and is integrating 4K imaging into both radiology and surgical workflows.

Asia-Pacific: Fastest-Growing Region

India, China, and Japan are emerging as high-growth markets due to rising healthcare expenditure, increased access to private healthcare, and a growing patient base. India's market is booming with the adoption of 4K technologies in urban hospitals, especially in fields like gynecology, oncology, and orthopedics.

Latin America & Middle East and Africa: Emerging Opportunities

Despite infrastructure and cost barriers, countries like Brazil, Saudi Arabia, and the UAE are investing heavily in medical modernization. Saudi Arabia’s Vision 2030 initiative is playing a pivotal role in driving the integration of 4K imaging into public hospitals to support precision diagnostics and surgeries.

New Publish Report

Competitive Landscape

Key players are focusing on strategic collaborations, product launches, and technological innovation to strengthen their market positions.

Leading Companies:

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew Plc

- Conmed Corporation

- Medtronic Plc

- Sony Group Corporation

- Fujifilm Holdings Corporation

- Hitachi Ltd.

Each of these companies has been evaluated across:

- Company Overview

- Key Personnel

- Product Portfolio

- Recent Developments & Strategic Initiatives

- Revenue Breakdown

Key Questions Answered

- What is the projected market size of the global 4K medical imaging industry by 2033?

- US$ 2.62 Billion

- Which imaging technologies are fueling growth?

- Endoscopy, MRI, CT, and video recording solutions integrated with 4K.

- How is video data management reshaping clinical workflows?

- By enabling secure archiving, faster retrieval, and better integration with digital health records.

- What role do image-guided surgeries play in market expansion?

- They significantly increase the demand for high-precision imaging tools.

- Which end-user segment leads the market?

- Hospitals dominate due to high surgical volume and capital investment capacity.

- Which regions are leading adoption?

- North America and Europe, with Asia-Pacific growing fastest.

- What challenges hamper adoption in emerging markets?

- High costs, limited IT infrastructure, and integration complexity.

- How do government initiatives (e.g., Saudi Vision 2030) impact growth?

- They promote healthcare modernization, driving faster adoption of advanced imaging systems.

- What are the latest strategies of key market players?

- Product innovation, acquisitions, and regional expansion.

- Which countries in Europe and Asia-Pacific are most active in this market?

- Germany, UK, Japan, China, and India.

Report Scope

Feature | Description |

Base Year | 2024 |

Historical Data | 2021 – 2024 |

Forecast Period | 2025 – 2033 |

Market Metrics | Revenue (US$ Billion) |

Segments Covered | By Type, By End User, By Country |

Countries Analyzed | United States, Canada, France, Germany, UK, China, Japan, India, Brazil, Saudi Arabia, and more |

Companies Profiled | 8 Key Players |

Customization | 20% Free |

Analyst Support | 1 Year Post-Sale |

Delivery Format | PDF & Excel (PPT/Word on request) |

Customization Services Offered

- In-depth regional analysis

- Additional country-specific data

- Company benchmarking and competitive profiling

- Market entry strategy & trade analysis

- Production and consumption insights

Need more insights or want to customize this report?

? USA: +1-478-202-3244

? India: +91-120-421-9822

? Email: [email protected]